The Bitcoin Additional functions within the Proof-of-Stake (POS) algorithm and does not require special equipment, making it possible to mine BTC without using large computing power. This is how it works:

- Exchange Bitcoin (BTC) to Bitcoin Additional (BTCa);

- Invest in masternodes: “freeze” coins on a special Quan2um Exchange wallet;

- Get your reward.

Why Bitcoin Additional is an eco-friendly way to mine Bitcoin

Bitcoin Additional is a fork of Bitcoin developed to spread its processing capabilities. The BTCa coin is backed by Bitcoin at a ratio of 1:1.

No need to purchase ASIC-mining equipment, build mining pools and pay high energy bills. You keep your cryptocurrency on a special account and get your reward based on the number of coins invested. The reward grows in proportion to the invested BTCa coins.

Masternodes are a series of servers that underpin a blockchain’s network and make online transactions more secure and rapid. Since it is quite complicated to create a masternode on your own, the BTCa team developed instant masternodes with completely equal features and functionality but the entry threshold is only 0.001 BTCa (≈ $40).

When you buy BTCa coins and invest in masternodes, you protect yourself against the volatile nature of Bitcoin and increase your income with the rise of Bitcoin.

Here are three typical cases concerned: what could happen if you invest in masternodes and the Bitcoin price would possibly increase, fall or stay about the same.

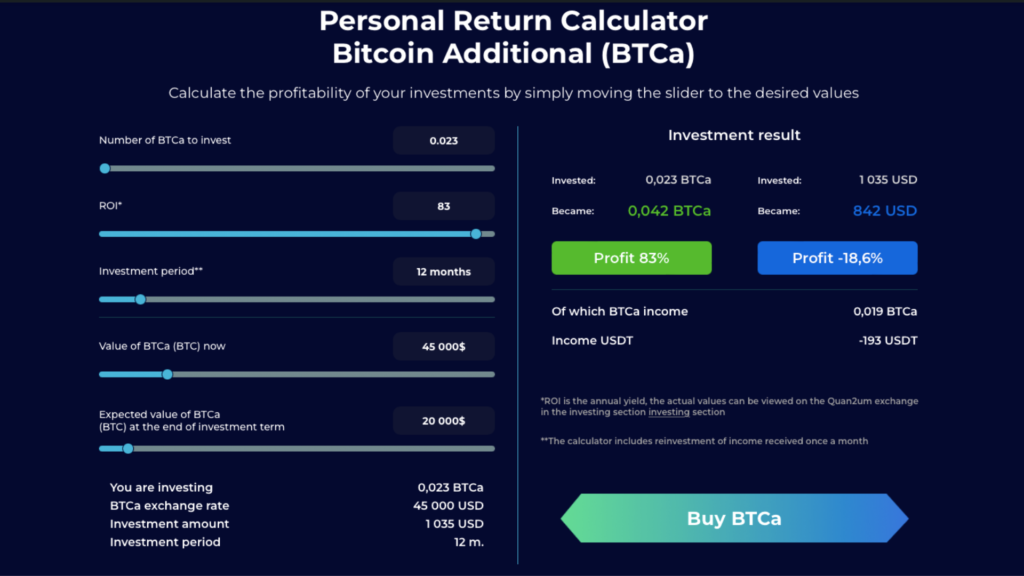

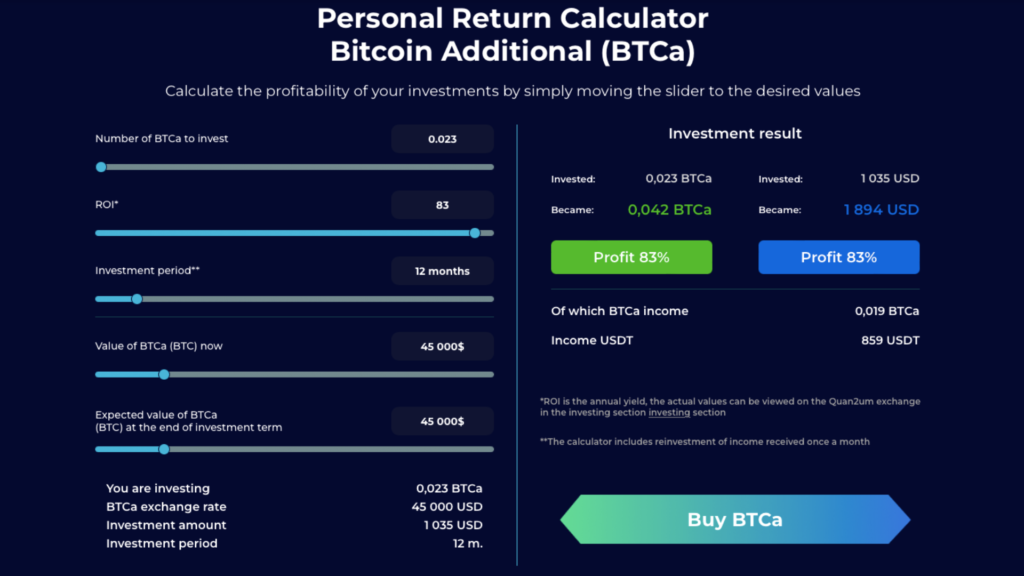

Peter invested in masternodes $1000 (≈0.023 BTCa) with the Bitcoin price $45 000 and ROI 83% under 12 months.

ROI (Return on Investment) — is a measure of an investment’s profitability. The most common method for calculating ROI is net income divided by the total cost of the investment, or ROI = Net income / Cost of investment x 100. Using this formula, ROI would be expressed as a percentage. Two aspects have been considered in the calculations below: mining reward and Bitcoin Additional price change. The actual masternode ROI values can be viewed on the Quan2um exchange.

1. Cryptoexperts predict Bitcoin could hit $200,000 in the coming years. Peter trusted the experts’ predictions and profit now is 713,3% or $7383.

2. Contrary to the positive prediction Bitcoin price fell sharply down to $20 000. Peter is frustrated, he has a negative balance with 18,7% decline. $100 turned into $841. Though Peter has a piece of good news: would Peter have invested in BTC coins, his account could have decreased down to $450.

3. Bitcoin prices have been trading within a reasonably modest range of $45 000. Peter’s income is $859 that is ROI 83% under 12 months.

The Bitcoin holding strategy has to date been a proven successful strategy. Since Bitcoin has shown as steady a rise in value over the years, thus long-term buy-and-hold strategy can be very successful in the cryptocurrency market. Long-term investing is essential to greater success.

Masternodes have no limits relating to time: freeze your cryptocurrency account for the one-week, one-month or one-year period.

Think over a long-term investment strategy (5 years): even the cryptocurrency 50% decline could operate profit due to the effects oа mining rewards. Bitcoin price, ROI and investment value stay the same: $45 000, 83% and $1 000.

| Investment period | 12 months | 5 years |

| ₿ increase up to $200 000 | + $7383 increase by 713,3% | + $22 655 increase by 2 188,9% |

| ₿ fell down to $20 000 | — $159 decrease by 18,7% | + $1 334 increase by 128,9% |

| ₿ stayed the same at $45 000 | + $859 increase by 83% | + $4 295 increase by 450% |

Calculate how much you expect to profit by means of our Investment Return Calculator on the Bitcoin Additional website.